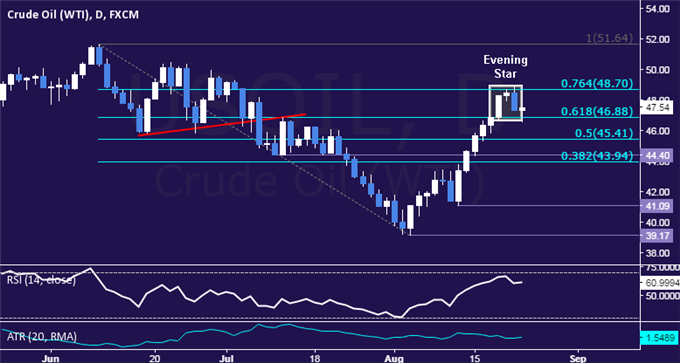

Oil costs were unassumingly higher on Friday in an unstable session, as brokers responded to remarks from Fed Chair Janet Yellen and reports of rocket movement in Saudi Arabia.

The business sector was taking its prompts from the development in the dollar, which has been rough after Yellen's comments.

At a certain point, unrefined benchmarks were up as much as 2 percent before floating lower.

Brent prospects for October were up 0.44 percent at $49.89 a barrel. U.S. unrefined was at $47.60 per barrel, up 27 pennies, or 0.55 percent.

The U.S. raw petroleum rig check was at 406, Baker Hughes said on Friday. That looks at to 675 a year back.

The business sector was prepared to respond to Yellen's discourse in Jackson Hole, Wyoming, as her comments at first brought on a major rally in the dollar, which made oil slip. Later, the dollar pared those increases, with the dollar list at one point down as much as 0.5 percent. It was recently up 0.3 percent.

Oil costs touched the day's highs after reports of Yemeni rockets hitting Saudi Arabia's oil offices, dealers said. Saudi state TV reported that a shot discharged from Yemen hit a force transfer office in Najran, in the southern piece of Saudi Arabia.

Sal Umek, senior examiner at the Energy Management Institute in New York, said he didn't see much impact available from the Saudi Arabia reports.

"By the day's end, what is driving the business sector at this moment is short covering, being that it's Friday and the dollar taking a hit," he said.

US oil rig number unaltered - Baker Hughes US oil rig check unaltered - Baker Hughes

Oil and characteristic gas dealers have likewise been looking for the effect of Tropical Storm Gaston, saying it could turn into a noteworthy typhoon in the Gulf of Mexico, taking out further supply.

A weaker dollar can be seen as steady at oil costs as it makes dollar-exchanged oil less expensive for nations utilizing different monetary standards, conceivably prodding request.

Oil costs were still on track for week after week misfortunes of more than 1 percent as the Saudi vitality pastor diluted desires that the world's biggest makers may concur one month from now to restrain their yield.

"We don't trust any critical mediation in the business sector is essential other than to permit the strengths of free market activity to take every necessary step for us," Saudi Arabian Energy Minister Khalid Al-Falih told Reuters late on Thursday.

Individuals from the Organization of the Petroleum Exporting Countries will meet on the sidelines of the International Energy Forum, which bunches makers and shoppers, in Algeria from Sept. 26-28.

More Update Like : Commodity Trading Signals , Forex Signals Advisory , Commodity Trading Picks ,Comex Trading Tips , Forex Trading Signals & Commodity Signals . .

.svg/541px-Asia_(orthographic_projection).svg.png)