SINGAPORE - IHH Healthcare Berhad is a main worldwide supplier of premium incorporated medicinal services administrations working in the home markets of Malaysia, Singapore, Turkey, and India. The Group contains premium-mark medicinal services resources, by and large speaking to a novel multi-market investment position in the human services division. Their "Mount Elizabeth", "Gleneagles", "Pantai", "Parkway" and "Acibadem" brands are among the most renowned in Asia and Central and Eastern Europe.

IHH Healthcare Berhad is the largest healthcare stock listed in Singapore stock market. The group is having a market capitalization of S$16.6 billion. The group runs 49 hospitals across the 9 countries.

The group's performance seems dramatic in its latest quarter.

The company's revenue and EBITDA (earnings before interest tax depreciation and amortization) were elevated from a year prior, profiting from the commitment of two recently opened hospitals, and organic growth from its existing hospitals.

Then again, the company’s net profit (after tax) for the quarter tumbled 40% after excluding one-off gains seen last year. Getting teeth issues, combined with higher operating, and devaluation cost were the primary offenders behind the decrease.

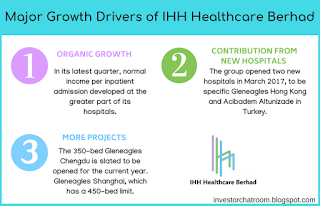

In any case, notwithstanding the lower main concern figures, there are still motivations to be idealistic for the company. There are growth drivers that can enhance the organization's edges and benefit later on. Let's talk about the growth drivers of IHH Healthcare Berhad -

Organic Growth of the Company

IHH Healthcare's arrangement of healthcare facilities is additionally creating more income after some time. In its latest quarter, normal income per inpatient admission developed at the greater part of its hospitals.

Over that, inpatient volume additionally expanded in all geographies aside from Malaysia. As the population ages and middle-class population grows, healthcare expenditure anticipated that would increment throughout the following couple of years. The patterns could give a tailwind to the organization's natural development for a long time to come.

Contribution from new hospitals

IHH Healthcare has a tremendous a system of hospitals, medical centers, and facilities, however, it has no aim to lay on its shrubs. The organization is forcefully re-investing its income into new activities, which incorporate the extension of its current hospitals and the advancement of new hospitals.

As said before, the group opened two new hospitals in March 2017, to be specific Gleneagles Hong Kong and Acibadem Altunizade in Turkey. The previous speaks to its first raid into China. The entire year income commitment from the two hospitals will happen this year.

As the two hospitals develop, their commitment to the primary concern ought to be more noticeable as the hospitals pick up footing, and the underlying coincidental working costs blur away.

More projects

IHH Healthcare has likewise started a couple of more projects that are expected for the consummation by 2019.

The stage 2 development of Pantai Hospital in Kuala Lumpur and the extension of Acibadem Maslak in Turkey will build the bed limit of the hospitals by 120 beds and 195 beds, separately. Over that, the 350-bed Gleneagles Chengdu is slated to be opened for the current year. Gleneagles Shanghai, which has a 450-bed limit, is likewise anticipated that would be finished in 2019.

These four projects, particularly the two new hospital openings in China, is probably going to drive income development.

There may be introductory getting teeth issues, and high start-up costs, however, the long haul affect from these openings will probably be sure for the company's primary concern.

Final thought-

As the opening of company's new hospitals, there will undoubtedly be here and now getting teeth issues that will eat into edges. Subsequently, the lower benefit we find in IHH's ongoing profit refresh.

IHH Healthcare has solid income from its activities and a sound asset report that should see it through any close term start-up challenges as it grows its impression in China. All things considered that once the new hospitals are completely up and running, the group will probably observe solid edges return together with solid primary concern development.

So investors should look out on the long-term performance of the company for the stock investment.

IHH Healthcare Berhad is the largest healthcare stock listed in Singapore stock market. The group is having a market capitalization of S$16.6 billion. The group runs 49 hospitals across the 9 countries.

The group's performance seems dramatic in its latest quarter.

The company's revenue and EBITDA (earnings before interest tax depreciation and amortization) were elevated from a year prior, profiting from the commitment of two recently opened hospitals, and organic growth from its existing hospitals.

Then again, the company’s net profit (after tax) for the quarter tumbled 40% after excluding one-off gains seen last year. Getting teeth issues, combined with higher operating, and devaluation cost were the primary offenders behind the decrease.

|

| IHH Healthcare Berhad |

In any case, notwithstanding the lower main concern figures, there are still motivations to be idealistic for the company. There are growth drivers that can enhance the organization's edges and benefit later on. Let's talk about the growth drivers of IHH Healthcare Berhad -

Organic Growth of the Company

IHH Healthcare's arrangement of healthcare facilities is additionally creating more income after some time. In its latest quarter, normal income per inpatient admission developed at the greater part of its hospitals.

Over that, inpatient volume additionally expanded in all geographies aside from Malaysia. As the population ages and middle-class population grows, healthcare expenditure anticipated that would increment throughout the following couple of years. The patterns could give a tailwind to the organization's natural development for a long time to come.

Contribution from new hospitals

IHH Healthcare has a tremendous a system of hospitals, medical centers, and facilities, however, it has no aim to lay on its shrubs. The organization is forcefully re-investing its income into new activities, which incorporate the extension of its current hospitals and the advancement of new hospitals.

As said before, the group opened two new hospitals in March 2017, to be specific Gleneagles Hong Kong and Acibadem Altunizade in Turkey. The previous speaks to its first raid into China. The entire year income commitment from the two hospitals will happen this year.

As the two hospitals develop, their commitment to the primary concern ought to be more noticeable as the hospitals pick up footing, and the underlying coincidental working costs blur away.

More projects

IHH Healthcare has likewise started a couple of more projects that are expected for the consummation by 2019.

The stage 2 development of Pantai Hospital in Kuala Lumpur and the extension of Acibadem Maslak in Turkey will build the bed limit of the hospitals by 120 beds and 195 beds, separately. Over that, the 350-bed Gleneagles Chengdu is slated to be opened for the current year. Gleneagles Shanghai, which has a 450-bed limit, is likewise anticipated that would be finished in 2019.

These four projects, particularly the two new hospital openings in China, is probably going to drive income development.

There may be introductory getting teeth issues, and high start-up costs, however, the long haul affect from these openings will probably be sure for the company's primary concern.

Final thought-

As the opening of company's new hospitals, there will undoubtedly be here and now getting teeth issues that will eat into edges. Subsequently, the lower benefit we find in IHH's ongoing profit refresh.

IHH Healthcare has solid income from its activities and a sound asset report that should see it through any close term start-up challenges as it grows its impression in China. All things considered that once the new hospitals are completely up and running, the group will probably observe solid edges return together with solid primary concern development.

So investors should look out on the long-term performance of the company for the stock investment.

No comments:

Post a Comment